→ (follow me on twitter: https://twitter.com/0xPemulis) ←

TLDR:

Metaverse, OHM forks, P2E gaming, ZK scaling solutions at the forefront of discussion. Cosmos ecosystem being discussed more and more.

Number go down; catalysts were probably tradfi rona selloff and profit-taking

This newsletter is new! This is just a casual list of news/interesting reads that come across my desk in a given week. Will come out every Sunday evening US time and cover the ~7 previous days of crypto activity.

NEWS

The Indian Government issued regulatory guidance on crypto; entails a ban on private crypto as means of payment to pave way for likely CBDC, but likely doesn’t touch crypto as an asset class. Commentary below 🏦 👇

Vitalik proposes EIP 4488: calldata parameter tweaks as a short-term optimization for L2 gas costs towards a rollup-centric ethereum

Prices nuke (BTC high 60’s to low 50’s, ETH 4.6 to 4) 📉

Most likely due to market froth causing big players to slow down bids

Personally, I see a bit of a correction coming now-early Q1 but likely to be short-lived (Not Financial Advice!!!).

BTC perpetual futures funding rate still high (30% in places)

OHM fork mania continues… ⚡️

02DAO, ATLANTIS, AtlasUSV, PepeBank, MysteryX, Nidhi, Cerberus, Mynos, RiseDAO, etc… all launched this week, each ~10-100M tvl

Snowdog DAO’s final day went roughly as planned - the first ~4 exits made 5-7 figures in profit, with all participants thereafter left holding the bag (~90% losses from pre-buyback prices)

Zhu Su’s “abandoning eth” tweet received a lot of mixed reviews on CT over the following (22nd-28th) week, with $AVAX price peaking soon thereafter at 140 before returning to 100-110 range (~20% drawdown from highs).

A flurry of on-chain activity on AVAX’s C-chain (partially surrounding the $SDOG finale) sent gas prices skyrocketing to ~$10-20 per transaction.

CT (crypto-twitter) has thoroughly debated this, although I personally side with the crowd that believes AVAX’s C-chain is merely a sidechain that inherits all the scalability issues of ethereum.

That said, I will readily admit that the AVAX C-chain is a much needed respite from eth L1 gas fees in the short-term and its modular consensus mechanism may still have unrealized potential.

Up-and-coming metamask competitor xdefi listed on gateio on the 22nd

First Candle: O: 0.20 H: 1.99 L: 0.20 C: 1.58; now (sun) trading ~$0.98

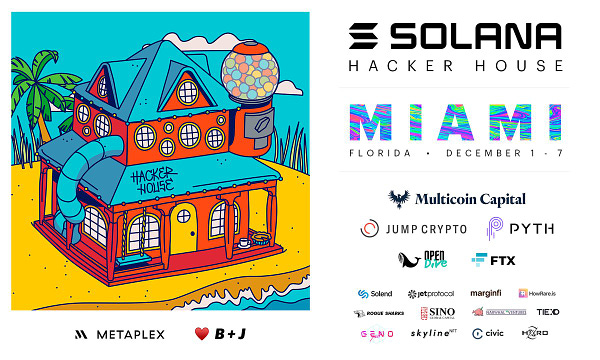

Solana Miami Hacker House announced:

Justin Bram, DeFi youtuber, joins Ondo Finance as head of growth.

I include this here as an example of how to break into web3; i.e. high quality, value-accretive independent content production pays dividends!

PODCASTS

Zero-Knowledge Podcast #207

Solana Podcast #53

Bankless ft. StarkWare

The FTX Podcast #90

GOOD READS

Useful DeFi tools thread

Classic reads compendium thread

Solana Validator 101: TPU (by Jito Labs (MEV research on solana))

Two new-ish analytics websites for ethereum scaling metrics!

L2beat: L2 scaling analytics

ethtps.info: … ethereum tps info lol

Old substack post from CT anon but I read it recently and think it’s an absolute must read: (mostly about market psyops)

Thanks for reading, stay tuned for next time, etc…

I do this partially to keep my notes up to date and in order, and partially because I think it might be a valuable resource. I don’t plan on shilling anything here or trying to commercialize or whatever. If you have suggestions, dm me on twitter @0xPemulis.

Also full disclaimer I am employed by Sino Global Capital and nothing expressed here represents an official stance or position taken by the firm. If that’s what you’re looking for, there’s plenty of grade-A SGC content over at Matthew Graham’s twitter account: https://twitter.com/mattysino.

awesome